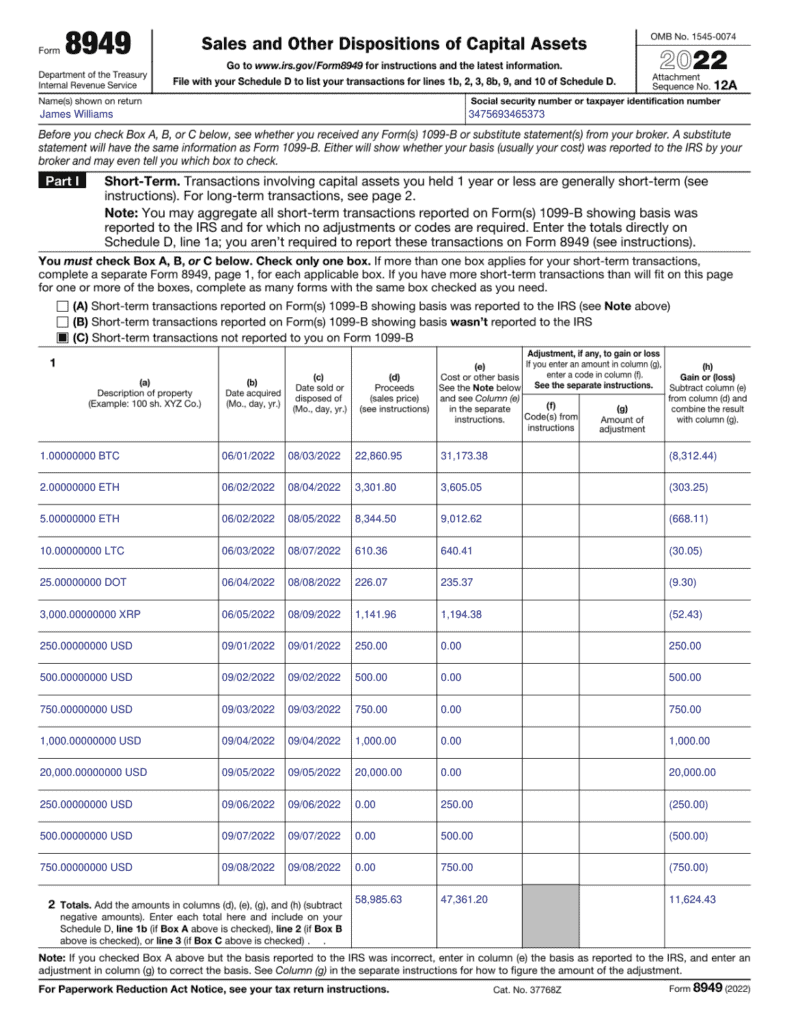

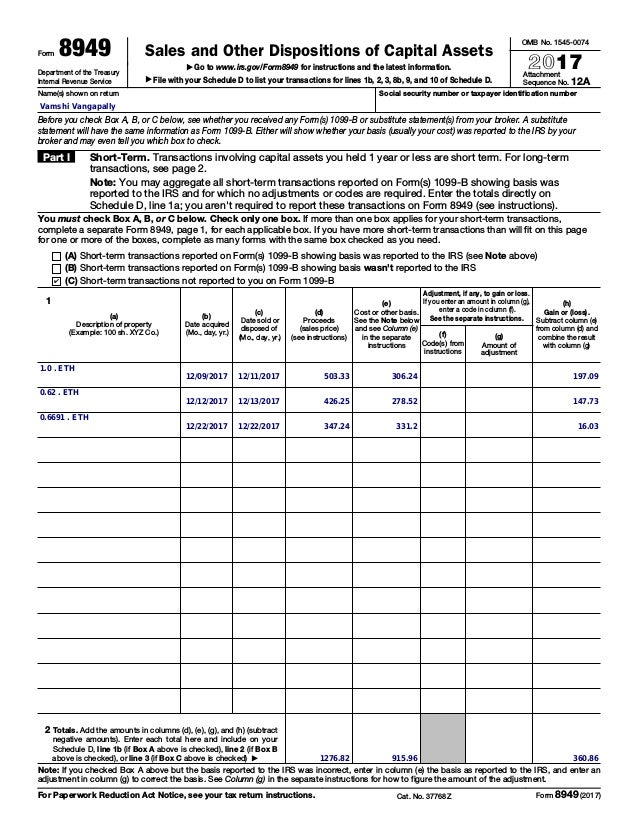

Form 8949 For 2025. Form 8949 is filled out first. Washington — the irs encourages tax professionals to register now for the 2025 irs nationwide tax forum, coming this summer to chicago,.

According to the irs, individuals, partnerships, corporations, trusts, and estates can use form 8949 to report the following: Form 8949 is filled out first.

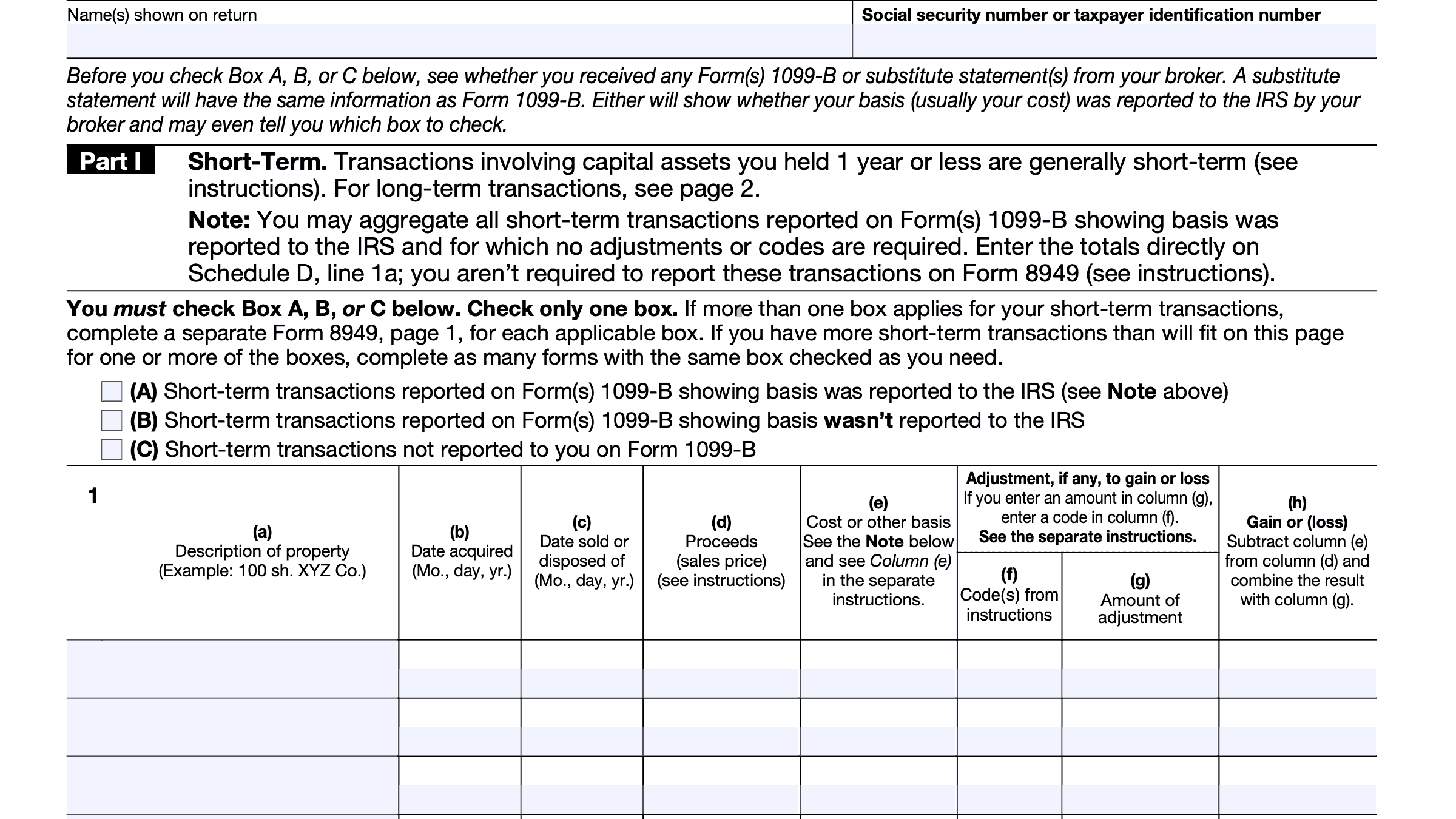

Form 8949 Fillable and Editable Digital Blanks in PDF, “this is necessary because very often digital asset. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs.

O objetivo do Formulário 8949 do IRS Economia e Negocios, The sale or exchange of a capital. Common questions about the schedule d and form 8949 in proseries.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

IRS Crypto Tax Form 8949 How to Fill Out Correctly in 2025, Learn how an update on the irs form 8949 may provide taxpayers with an easier way to report sales and other dispositions of capital assets. Transfer the totals from form 8949 to schedule d of your tax return.

How To Mail In Your IRS 8949 With Crypto Trades CoinLedger, Net capital losses against ordinary income are. Taxpayers use form 8949 to report sales and exchanges of capital assets.

How to Fill Out Form 8949 for Cryptocurrency, What is form 8949 and what is its purpose? The form also includes a box to indicate “that a sale is not recorded on the distributed ledger,” she said.

Form 8949 Exception 2 When Electronically Filing Form 1040, Form 8949 allows you and the irs to reconcile. Form 8949 is essential for detailing each capital asset transaction you've made during the tax year.

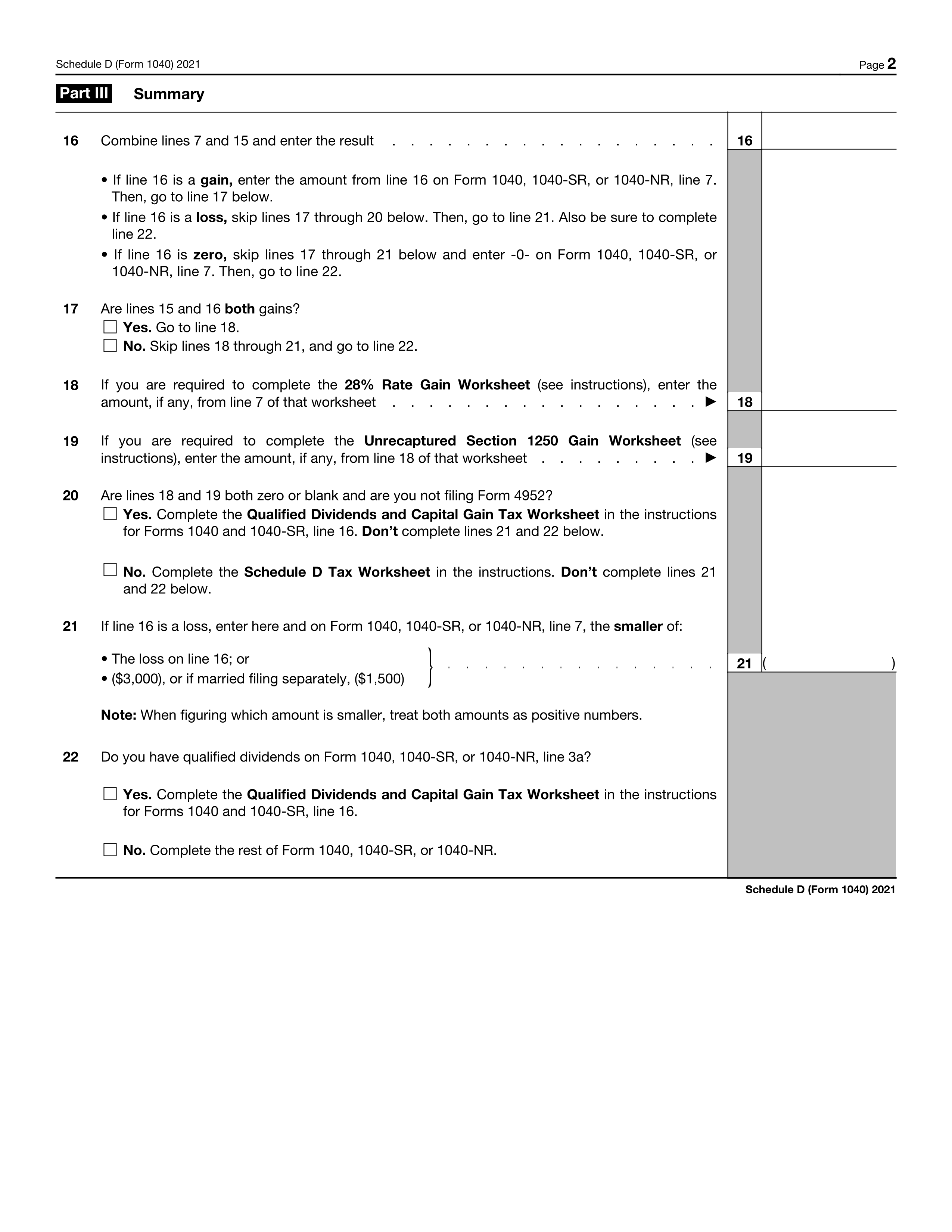

IRS Schedule D, The role of form 8949 in reporting capital assets. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs.

Sample 8949 Document BearTax, Form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Sales and other dispositions of capital assets is an internal revenue service (irs) form used to report capital gains and losses from investments.

IRS Form 8949 Instructions Sales & Dispositions of Capital Assets, The sale or exchange of a capital. Form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made.

IRS Form 8949 Sales and Other Dispositions of Capital Assets, Starting in tax year 2025 the. Solved•by turbotax•7246•updated february 23, 2025.

:max_bytes(150000):strip_icc()/Form8949IRS2022-c2328904f30a4929b7e69d11e8caf51b.jpg)

You report every sale of stock during the year, identifying the stock, the date you bought it, the date you sold it, and how much you.

These transactions must be reported on form 8949, sales and other dispositions of capital assets, and form 1040, u.s.